Display Invoice Report with the Correct Status when a Credit Note is Added to the Invoice

Credit notes are documents that prove the seller added a credit balance to the client’s account as a refund or to correct a transaction error. The client can use this credit to pay future invoices or other payments.

Transactions resulting from adding a credit note to a sales invoice may be processed incorrectly, which requires accounting adjustments.

Now, we’ll take you through some scenarios of the system’s accounting response to adding a credit note to invoices, and demonstrate how to handle each of these cases correctly.

Identify the Options of the Setting "Autopay Invoices if the Client Has Available Credit"

Invoice payment statuses are automatic statuses that are updated based on the payment transactions on the invoice without any manual intervention. The invoice status appears as “Paid” or “Unpaid” in the invoice as well as the invoices reports.

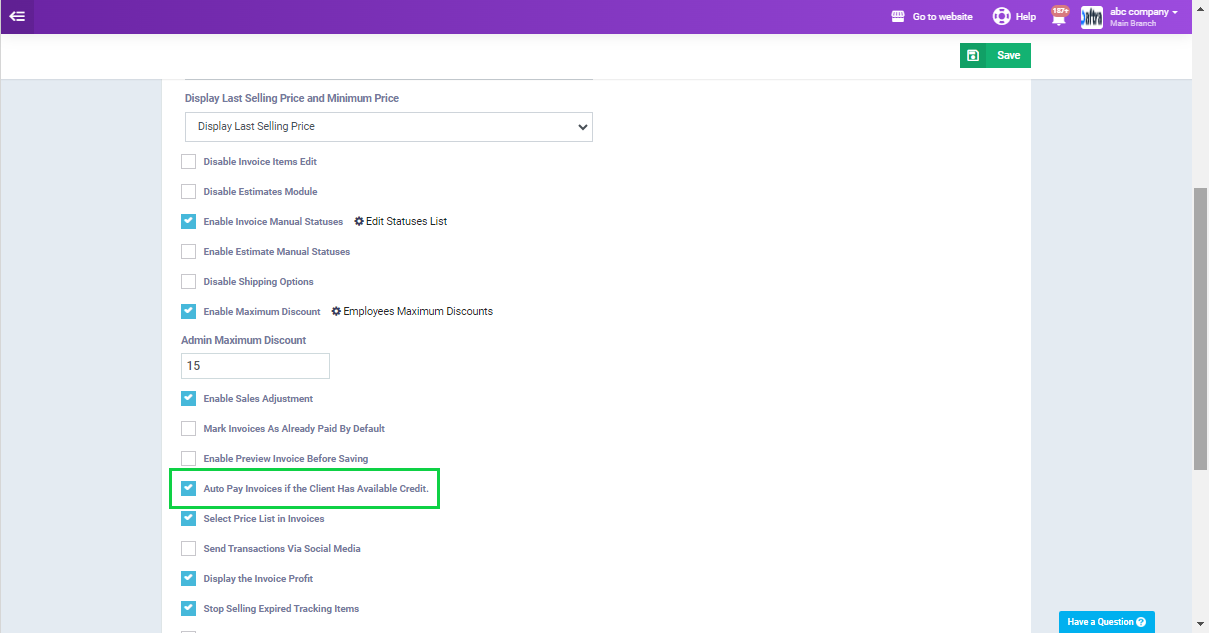

When adding a credit balance to a client, this balance may automatically be used to pay invoices and may not, depending on whether the setting “Autopay invoices if the client has available credit” is enabled or not.

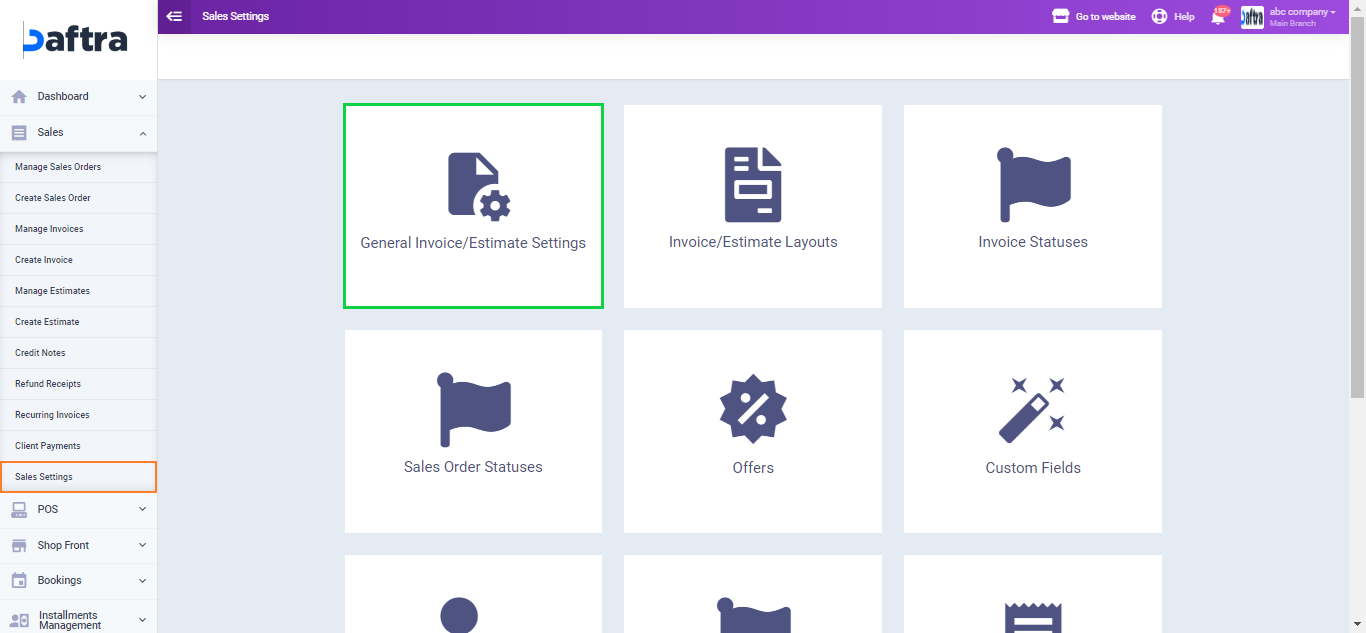

Here are the setting activation steps:

From the dropdown of “Sales” in the main menu click on “Sales Settings” then select “General Invoices/Estimates Settings“.

Click on “Autopay Invoices if the Client has Available Credit” to activate it.